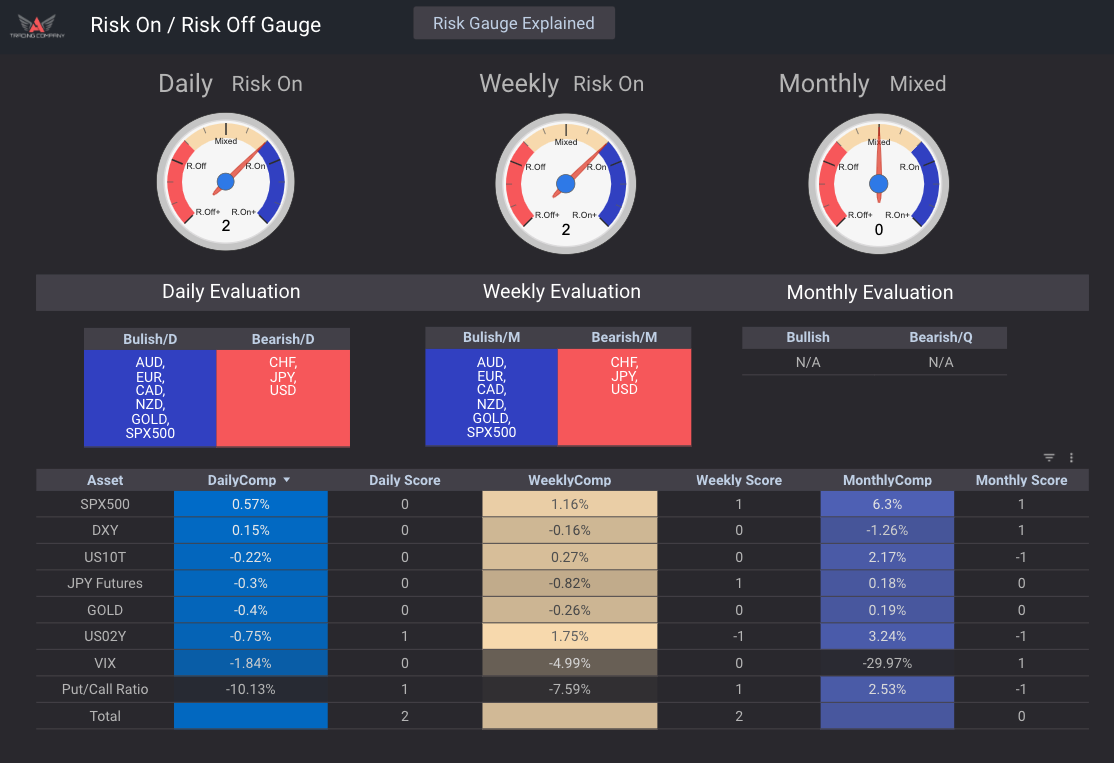

When the market sentiment is bullish and economic conditions appear favorable, investors are more inclined to borrow money at low interest rates and invest in higher-risk, higher-return assets like stocks. As a result, demand for riskier currencies, which tend to be correlated with commodities or emerging markets, rises. These currencies typically include the Australian Dollar (AUD), New Zealand Dollar (NZD), and Canadian Dollar (CAD).