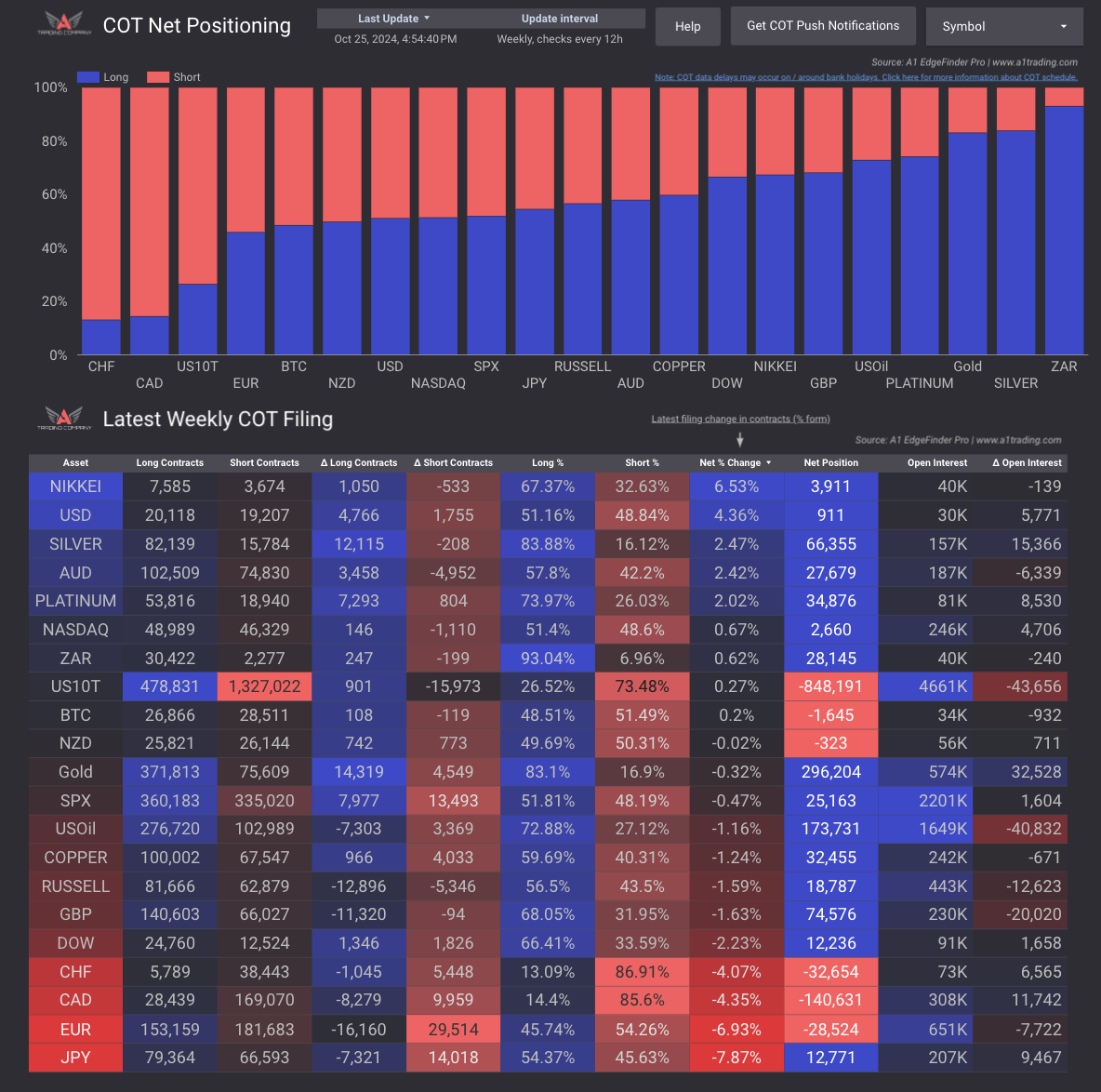

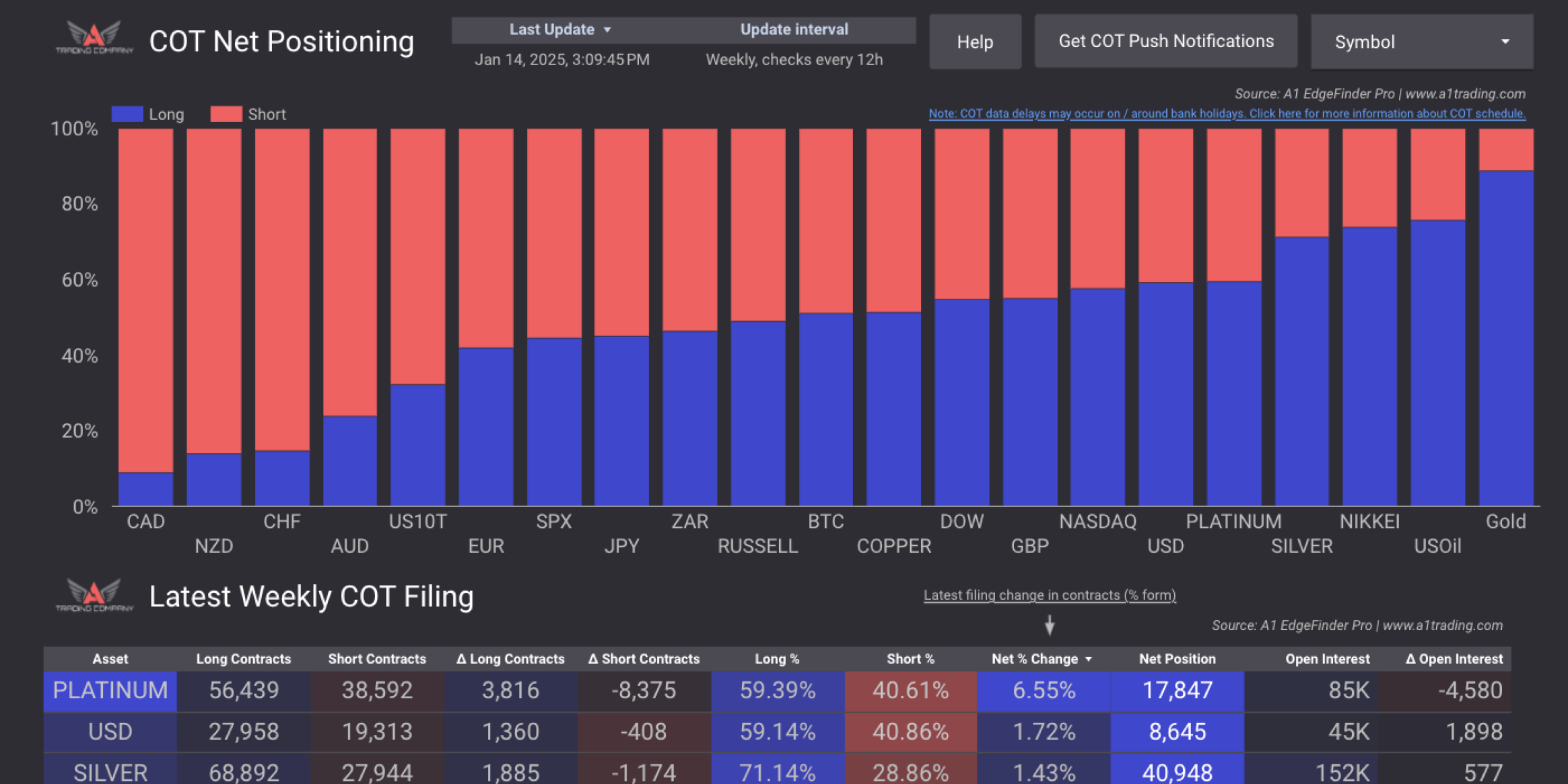

Non-commercial traders, also known as large speculators, include asset managers, hedge funds, and banks. These entities trade futures contracts with the primary goal of speculating on price movements. The positions of these traders are what we focus on in the EdgeFinder, as they can provide signals about the market's future direction.

Non-commercial traders are driven by profit motives and employ sophisticated trading strategies to capitalize on market trends. Their activities can significantly influence market prices, making it essential for retail traders to monitor their positions. By understanding the actions of non-commercial traders, retail traders can gain valuable insights into market sentiment and potential price movements.