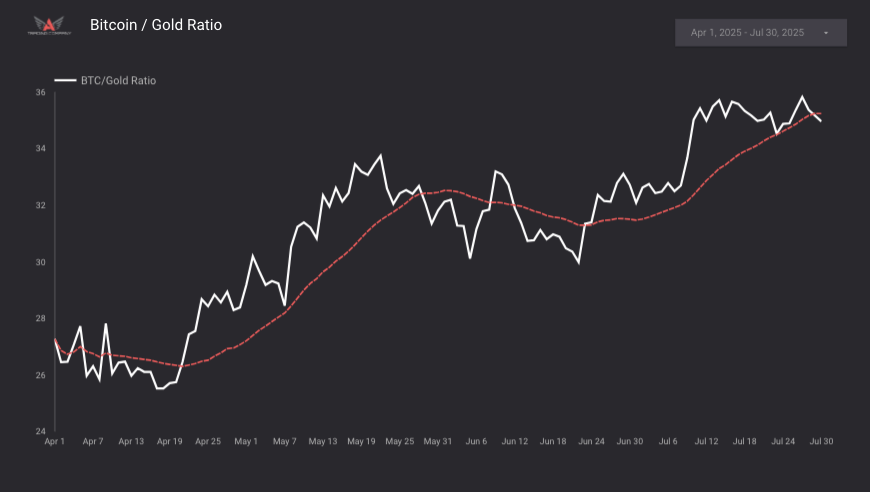

Rising Ratio = Risk-On Sentiment

A climbing Bitcoin to Gold ratio generally indicates strong performance in speculative assets like tech stocks and crypto. This is typically a time when investors are optimistic and favor higher returns despite higher risks.

Falling Ratio = Risk-Off Sentiment

When the ratio declines, it signals a shift to safer investments like gold, the U.S. dollar, or the Japanese yen. This may occur during times of economic uncertainty, inflation concerns, or geopolitical risk.

Trend Direction vs. Mean Reversion

In the short term, traders can use the 20-period moving average on the chart to gauge momentum. If the ratio is trending above the moving average, it supports a bullish risk environment. Over the long term, extreme deviations from the average may point to potential mean reversion opportunities.