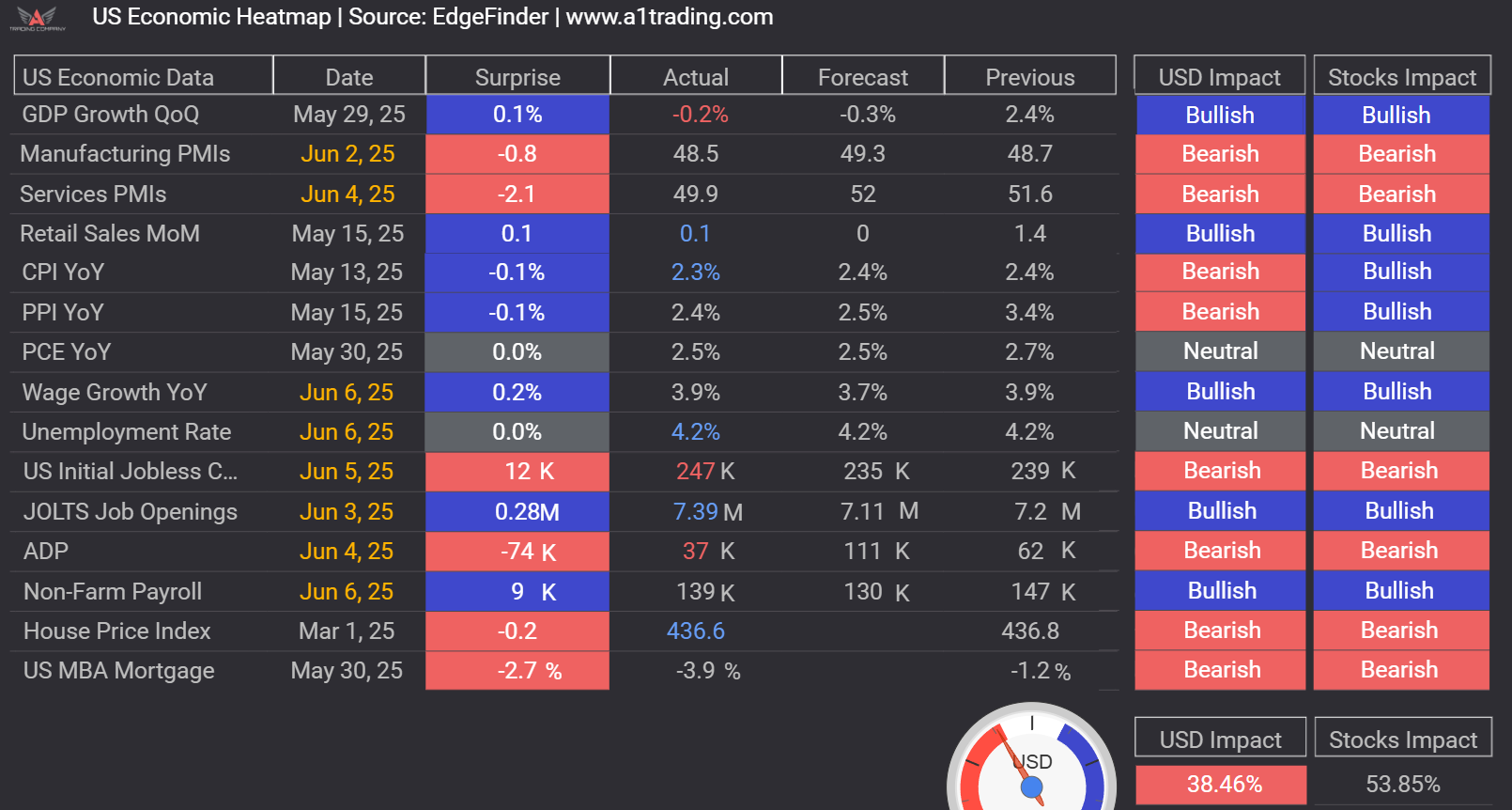

One of EdgeFinder’s standout features is the Economic Heatmap, which visualizes the health of major economies using key metrics like GDP, CPI, PMIs, wage growth, and non-farm payrolls.

It’s available for: U.S., Eurozone, UK, Japan, Canada, Australia, New Zealand, Switzerland, and China.

Markets move on surprises—not just raw data—so EdgeFinder highlights the difference between forecast and actual results, showing how the market is likely to react. For instance: