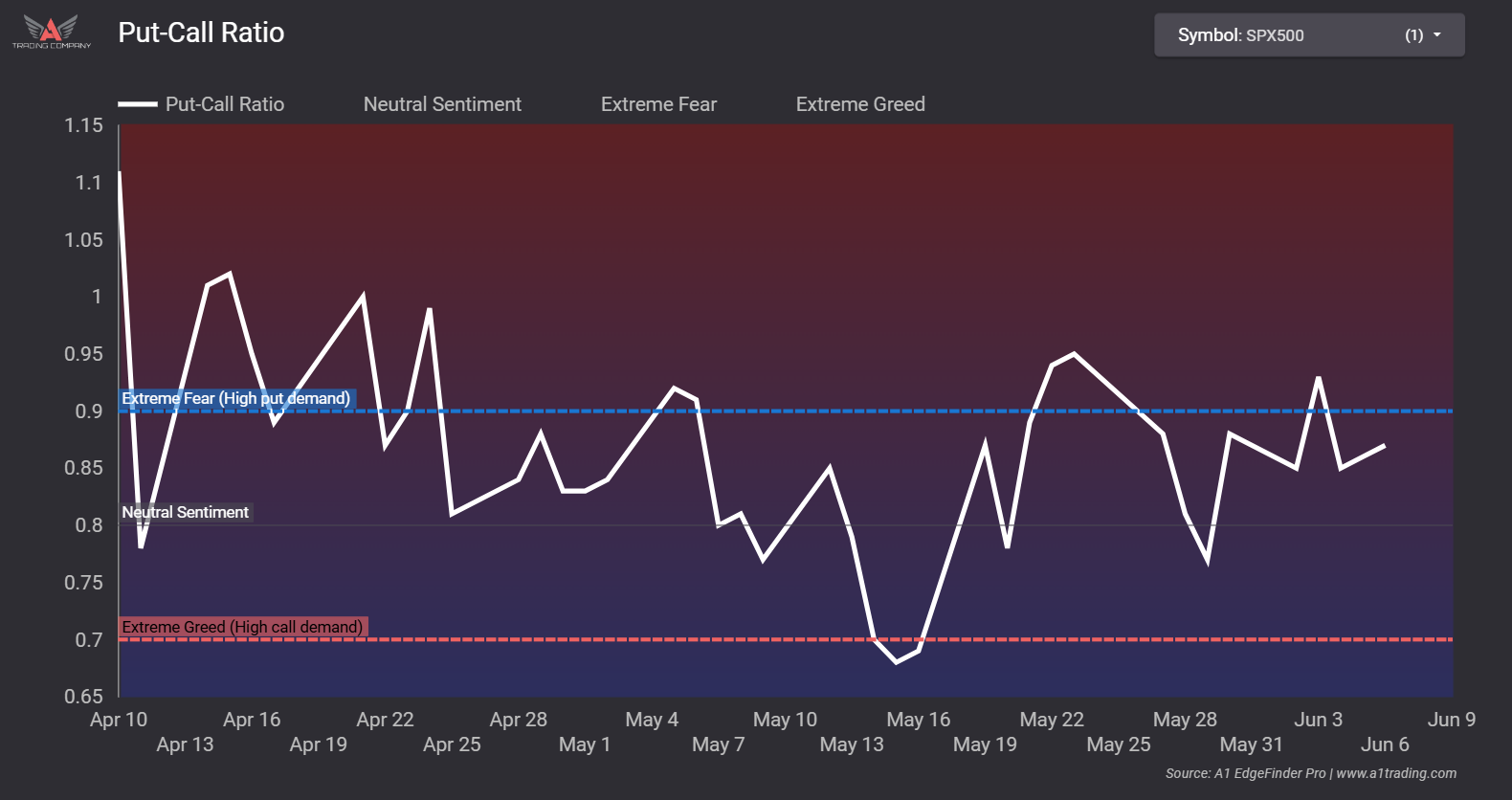

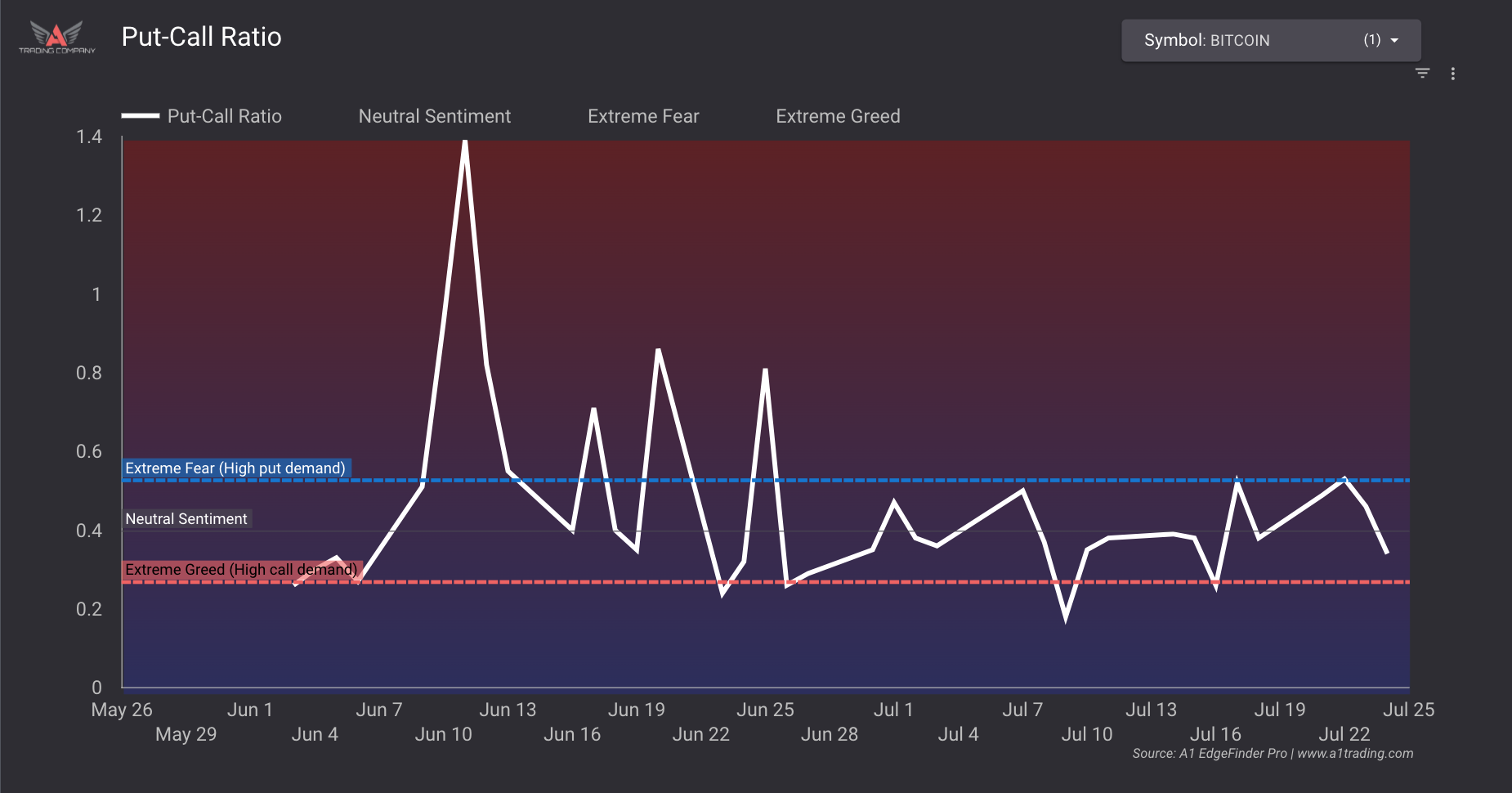

The Put/Call Ratio (PCR) measures how many put options (bearish bets) are being bought compared to call options (bullish bets) over a given time period. It’s calculated by dividing put volume by call volume:

Put/Call Ratio = Put Volume ÷ Call Volume

While modest PCR readings can support the prevailing trend, extreme levels often serve as contrarian signals—suggesting a potential turning point in market sentiment.