S&P 500 holds near highs, but Fed cuts could spark short-term volatility before medium-term bullish momentum resumes.

By the end of this article, you'll know how to use the currency strength meter in ways that will both save you time and help you find better trade setups!

The currency strength meter is a tool that helps trend traders determine what is moving in the foreign exchange market. Simply put, the currency strength meter acts as a currency heat map to show overall change in price. Instead of having to go chart to chart to find the best trends, the Currency Strength Meter will objectively tell you what currencies are strong and what currencies are weak.

The currency strength meter uses a combination of price action, the relative strength index, and stochastic indicator. The tool will calculate and order the 8 major currency pairs from strongest to weakest (JPY, NZD, CHF, EUR, AUD, USD, CAD, & GBP). In addition, the strength meter will determine the best currency pairs for trend trading or range trading, and deliver them in real time to the user.

Further, the currency strength meter is configurable to any time frame. Therefore, users have the ability to use the tool from the 1 minute chart, all the way to the 1 month chart.

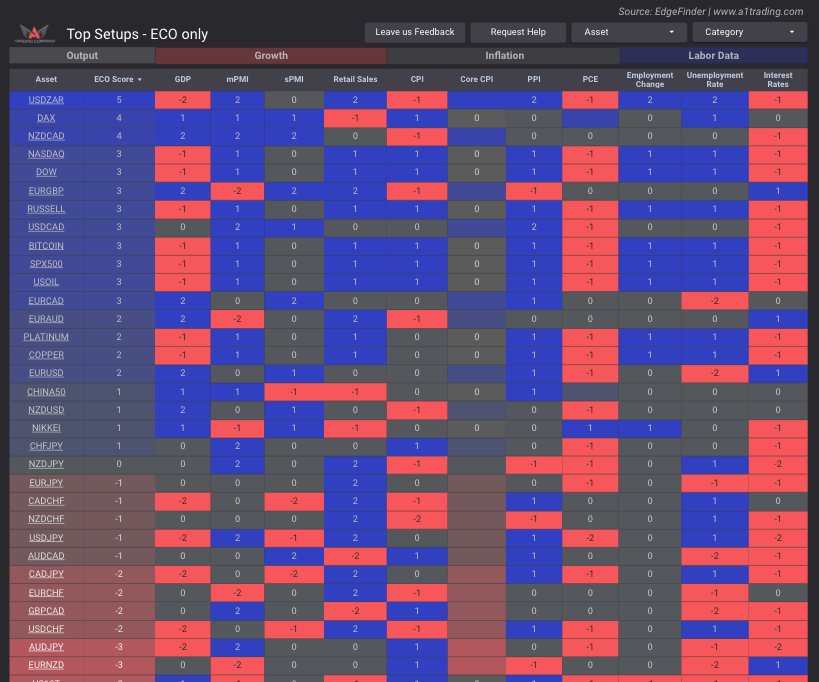

Using the currency strength meter, traders can pay attention to the heavily trending markets to look for buying or selling opportunities. For example, if you pay attention the the image below you can tell that GBP/JPY is trending the strongest. This could offer an opportunity for pullback buys and setups onGBP/JPY pairs.

For traders who like trading sideways or choppy market environments, the "sideways pairs" section may help identify markets to trade. Traders could use this feature to easily find opportunities to sell across the tops or buy across the bottoms.

Additionally, the tool can be used to easily spot strong movements across different timeframes. In the image below, you can see that USDCAD is overall bullish on the monthly down to the 30 minute chart. This gives the user trade ideas to go look for based on the momentum scan.

The currency strength meter is perfect for trend traders who are looking for high probability opportunities. Whether you are looking to trade bullish markets, bearish markets or sideways trending markets this tool can help identify these trends so you don't to have to go looking for them! We have created a handfull of similar tools to help make your trading more efficient. Check out a list of our scanners, indicators and robots here. Looking to get your hands on this tool? Get more information:

Additional Resources:

S&P 500 holds near highs, but Fed cuts could spark short-term volatility before medium-term bullish momentum resumes.

DXY holds near support as traders await FOMC, with three cuts priced and data setting the next move.

Sterling stalls at resistance as soft UK growth data shifts attention to next week’s BoE meeting and balance sheet risks.