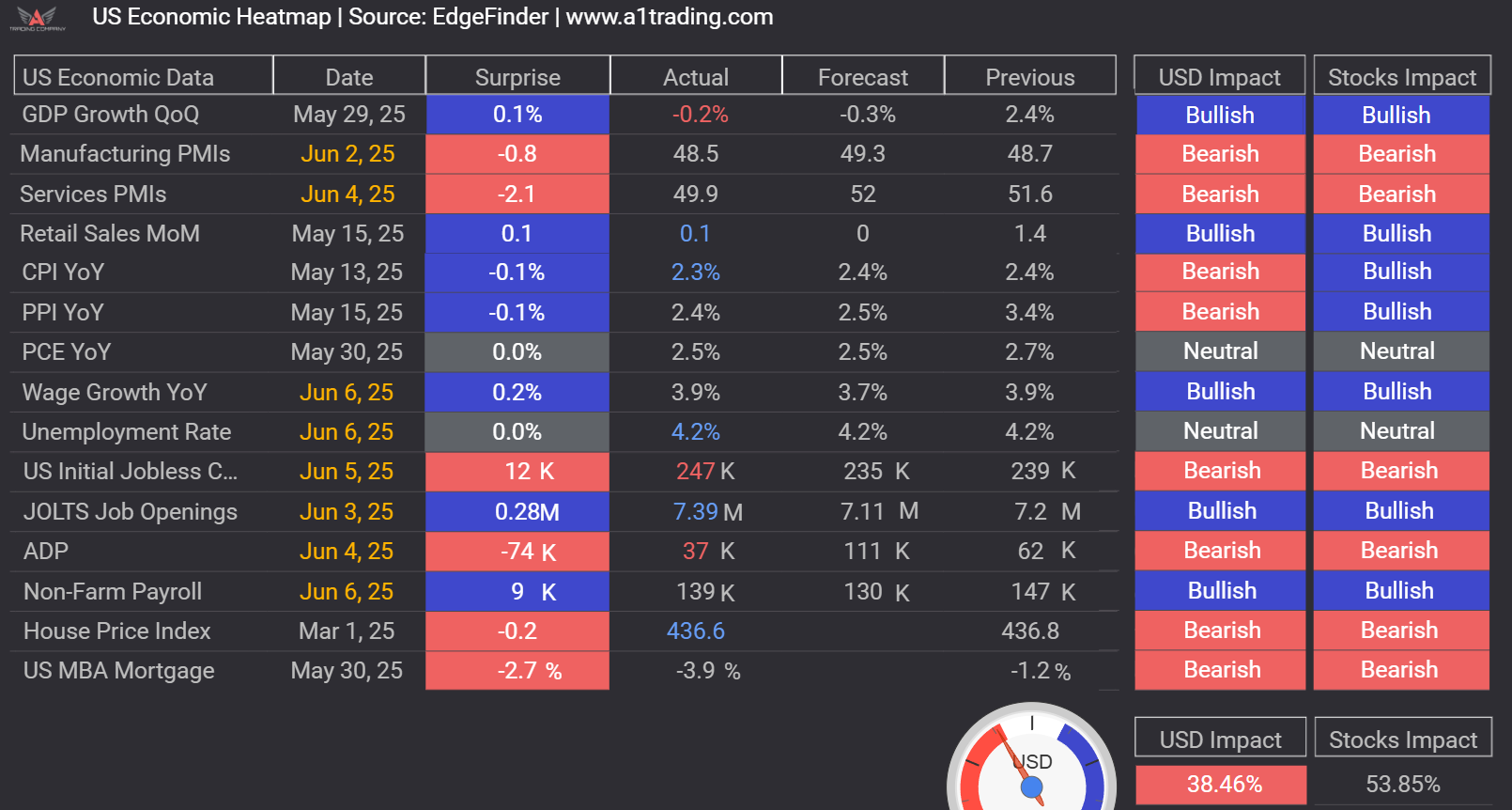

S&P 500 holds near highs, but Fed cuts could spark short-term volatility before medium-term bullish momentum resumes.

DXY holds near support as traders await FOMC, with three cuts priced and data setting the next move.

Sterling stalls at resistance as soft UK growth data shifts attention to next week’s BoE meeting and balance sheet risks.

Here’s the full breakdown of my $17,000 silver trade—why I entered, how I managed it, and what’s driving silver.

Recently, I shared a video where I argued that trading psychology is overrated in the trading space. As you might expect, the responses were strong—some in agreement, some in sharp disagreement.

If you missed the original video, I’ll give you the short version here: discipline and emotional control are certainly required in trading, but they’re not the hardest part of becoming profitable.

Marko Greguric joins LINDEX as a market analyst, leveraging his prop trading experience and disciplined approach to enhance traders' skills.