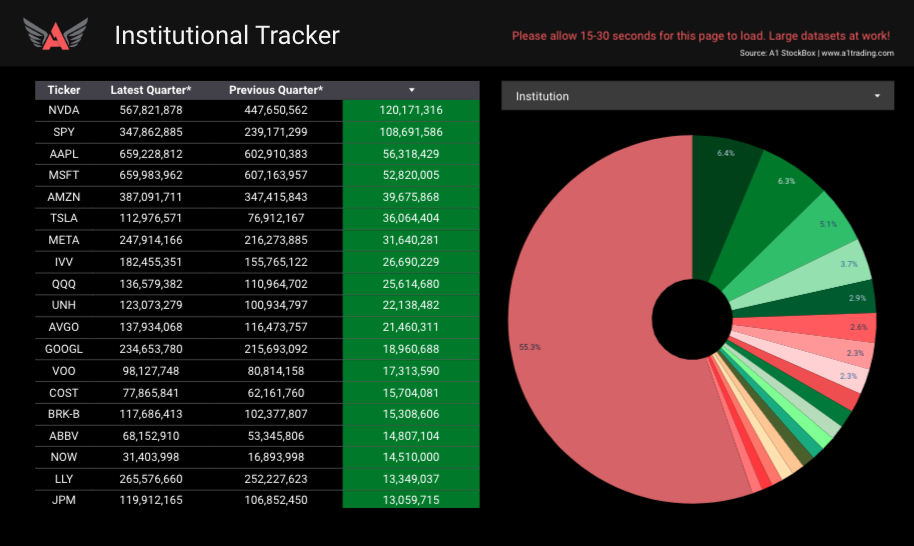

The Institutional Tracker inside the LINDEX StockBox is designed to help traders and investors follow the activity of major financial institutions. By analyzing quarterly portfolio filings from firms like Morgan Stanley, JP Morgan, and Berkshire Hathaway, the tracker highlights where “big money” is flowing—both into and out of the market.